Have any questions? Contact us!

Contact us

FREE Real-Time Index Quotes

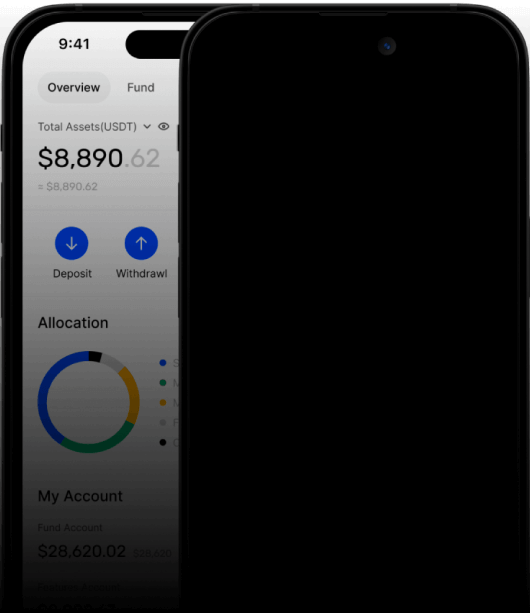

Quick and Easy Account Funding

Protected & secure

Your data is safe and your funds are kept in segregated bank accounts, in accordance with regulatory requirements.

Professional support

Get around-the-clock dedicated customer service in multiple languages.

Reliable

Your data is safe and your funds are kept in segregated bank accounts, in accordance with regulatory requirements.

Regulated

AiStrategy is authorised and regulated by the British Financial Supervision and Resolution Authority (Licence no. 4.1-1/18).

Start Trading Today!

Your journey in trading begins with this small step—creating an account in the Trader's Cabinet, which will allow you to open real trading accounts. It will only take a few minutes.

Indices FAQ

A stock index is a performance indicator or measure of a country's economy or of an industry sector. For example, Nasdaq 100 represents the largest 100 companies traded on the Nasdaq Stock Exchange. If, on average, the share price of these companies goes up, then the index will rise. Conversely, if they fall, the index will drop.

Most main indices are based on a basket of shares and are thus considered good measures of the current market sentiment. When you take a position on an index, you are effectively investing in the performance of these shares and thus avoid factors that influence the performance of individual companies (such as a lack of market volume). For a full list of index futures CFD offered on the AiStrategy platform, click here.

Stock market indices have different forms of calculation. These are the two most common:

- Adjusted market capitalisation (or cap-weighted) is used to track a number of companies based on the adjusted market capitalisation of the constituent stocks. Large-cap companies have a greater impact on the index’s price than small-cap companies. S&P 500is an example of an index that is calculated this way.

- Price-weighted average – adds up the stock prices of all constituents, and then divides that figure by the total number of stocks in the index. Dow Jonesis an example of an index that is calculated this way.

By trading index futures contracts with leverage, you can multiply the value of a trade through the use of borrowed capital, and as such, you can increase the potential profit or loss to be realised from the trade. The available leverage for index CFDs on the AiStrategy platform is up to 1:20.

Here are a few highlights of trading Index CFDs:

- You can gain diversified exposure using a single instrument – as most factors that affect individual companies are taken out of the equation.

- More trading opportunities – we offer access to a wide range of indices from the world’s largest and most important stock markets.

- Enjoy tight spreads and zero commissions on real-time index quotes, charts, deposits and for opening / closing trades with AiStrategy.

To explore more highlights and possible advantages of index CFDs, read our "What Are Indices" article.