What is an ETF?

An exchange-traded fund (ETF) is an investment fund that holds a collection of assets like stocks, bonds, or commodities and trades on a stock exchange like an individual stock.

Earn on rises and falls

Benefit from market prices moving up or down with CFDs on the most popular digital assets

Trade 7 days a week

Unlike most other assets, digital assets can be traded all week long with only brief breaks

Capitalise on high volatility

While swift and unexpectable price shifts can prove risky, you can use them to earn more

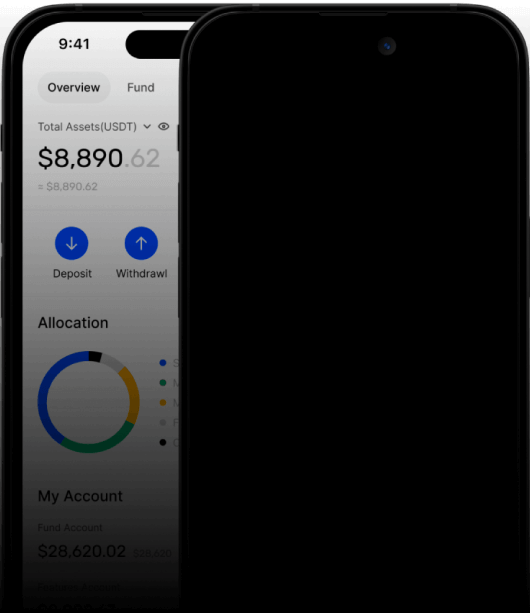

Start digital trading with no stress

Protected & secure

Your data is safe and your funds are kept in segregated bank accounts, in accordance with regulatory requirements.

Professional support

Get around-the-clock dedicated customer service in multiple languages.

Reliable

Your data is safe and your funds are kept in segregated bank accounts, in accordance with regulatory requirements.

Regulated

AiStrategy is authorised and regulated by the British Financial Supervision and Resolution Authority (Licence no. 4.1-1/18).

Start Trading Today!

Your journey in trading begins with this small step—creating an account in the Trader's Cabinet, which will allow you to open real trading accounts. It will only take a few minutes.